As seen in

Wondering how these 23 year old prodigies own 20 properties?

The answer is DSCR.

DSCR (debt service coverage ratio) loans are evaluated based on the property’s rental income, not the applicant’s personal income.

So your portfolio’s growth isn’t restricted by your personal income and there’s no limit to the number of properties you can own.

Approval is faster and easier too because there’s no painful personal income verification.

You can close in an LLC with as little as 20% down — even using short term rental income.

Why Beeline for

DSCR loans?

Tailored DSCR application flow

A dedicated online DSCR experience that doesn’t cram you down the normal path and ask you for personal income and W2s.

More DSCR options means you’re more likely to qualify.

If you want to qualify with the property’s rent we have different DSCR options to suit different situations.

Get certainty faster.

You’ll get a reliable approval and loan options in quick time, so you can calculate your exact ROI right then and there.

Fast, stress-free closing.

Your dedicated Loan Guide, your Beeline Tracker and our tech mean less back and forth and you’re always in the loop.

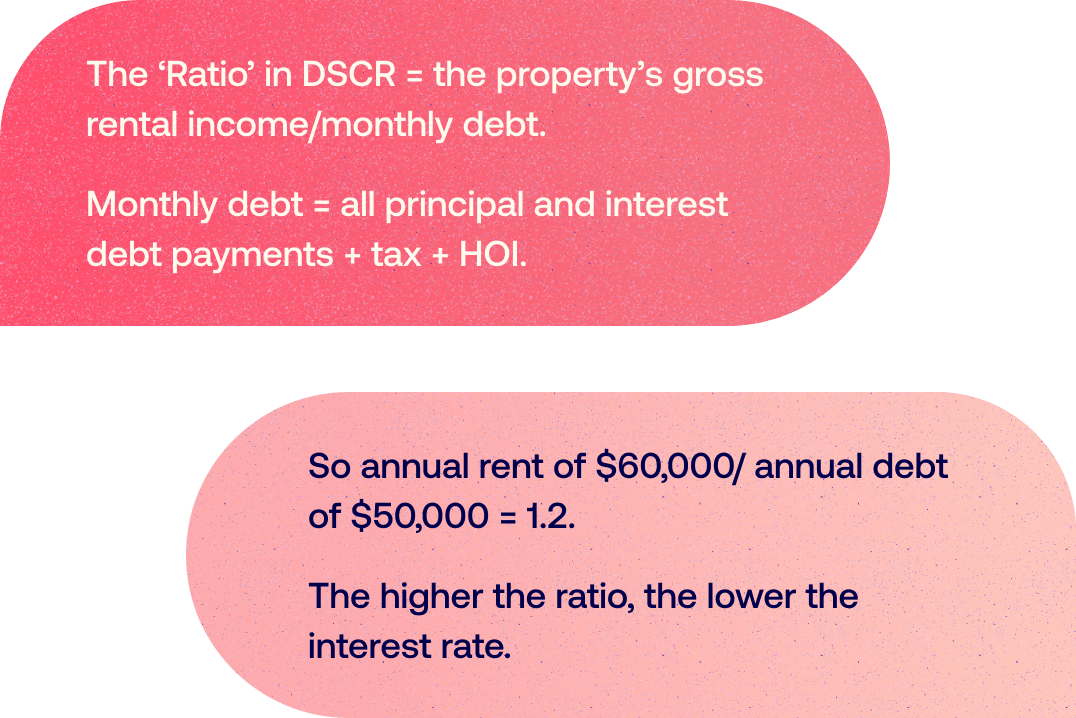

What the heck is DSCR?

You can only grow your portfolio so much using personal income. So why not spread your wings and get into the world of DSCR?

What is DSCR you may be asking?

DSCR stands for Debt Service Coverage Ratio.

Eligibility for DSCR loans is based on verifying the rental property’s income, not your personal income, tax returns and pay stubs.

Conventional loans rely on your income to support extra loan payments — so after a couple of properties, you max out your ability to borrow (unless you earn squillions).

That’s where DSCR loans come in.

They transform newbies into cigar wielding tycoons.

But while DSCR loans have advantages, rates are slightly higher so if your income isn’t maxed with other properties, a conventional loan might be better. We can help you decide.

What the heck is DSCR?

What you need to access the world of DSCR.

A credit score of at least 580.

At least 12 months’ history of paying either mortgage or rent payments.

Total annual rent should cover your principal, interest, insurance, property taxes and HOA fees (if applicable).

A minimum of 20% downpayment.

Reserves to cover 6 months’ worth of payments.

Long and short term rentals like Airbnb are ok.

Investment property loans FAQ

Can I borrow through my LLC?

What's the minimum loan amount?

What's the minimum down payment for investment loans?

What's the deal with DSCR?

Can I do a cash out refi DSCR loan?

Do you do Fix n Flip loans?

Do you offer interest-only options for investment properties?

DSCR loans suit tycoons and investors just starting out.

We love seeing people taking steps towards financial freedom.

Whether that’s smoking fat obnoxious cigars on a yacht or just working a little less hard — we’ll leave that up to you.

So let’s get the loan out of the way — so you can watch that rent roll in and move onto the next one!